AccountingTools

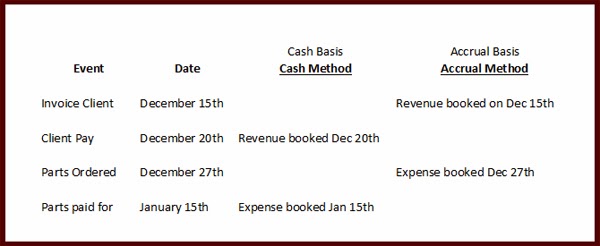

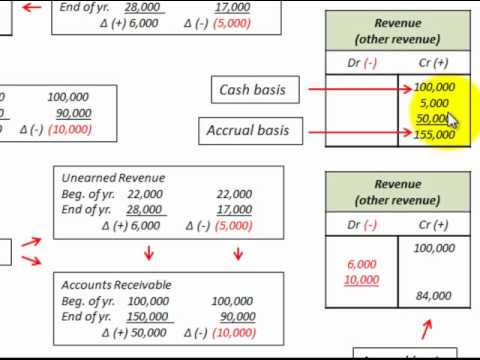

We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. If your business is a corporation (other than an S corp) that averages more than $25 million in gross https://seikoiamhappy.com/do-i-need-to-pay-taxes-if-i-do-not-make-revenue-as receipts each year, the IRS requires you to use the accrual method. This example displays how the appearance of income stream and cash flow can be affected by the accounting process that is used.

Do Accrued Expenses Reverse Year End Closing?

This way you can put revenue into the correct period and accrue for any expenses occurred in that period that might not have been paid. To accrue means to accumulate over time, and is most commonly used when referring to the interest, income, or expenses of an individual or business. Accruals refer to earned revenues and incurred expenses that have not actually been realized.

See for yourself how easy our accounting software is to use!

All accounts payable are actually a type of accrual, but not all accruals are accounts payable. Patriot’s online accounting software is easy-to-use and made for the non-accountant. Accrued liabilities are usually recorded at the end of an accounting period. Accrued liabilities recognize any unrecorded expenses incurred but not billed.

Revenue is the money a business generates by selling products and services to customers. The result is that a company’s reported revenue for a particular period typically differs from the cash it collects from customers during that period. A local lender issues a loan to a business, and sends the borrower an invoice each month, detailing the amount of interest owed. The borrower can record the interest expense in advance of invoice receipt by recording accrued interest.

And you’ll need one central place to add up all your income and expenses (you’ll need this info to file your taxes). As you can see, accrual accounting recognizes economic events in certain periods regardless of when actual cash transactions occur. Accrual accounting is the opposite of cash accounting, which recognizes economic events only contra asset account when cash is exchanged. For individuals, I can’t think of any reason why would accrual basis be better than cash, or why would an individual use a fiscal year other than the calendar year. An accrued dividend is a liability that accounts for dividends on common or preferred stock that has been declared but not yet paid to shareholders.

An accrual is something that has occurred but has not yet been paid for. This can include work or services that have been completed but not yet paid for, which leads to an accrued expense. Cash accounting is the other accounting method, which recognizes transactions only when payment is exchanged. The method follows the matching principle, which says that revenues and expenses should be recognized in the same period.

You can see a trend analysis because you recognize revenue and expenditures in the period in which the revenue was earned and the expenses accrual method accounting occurred. However, startups or small businesses should ask themselves some basic questions before choosing between cash and accrual.

Under the double-entry bookkeeping system, an accrued expense is offset by a liability, which appears in a line item in the balance sheet. If accrued revenue is recorded, it is offset by an asset, such as unbilled service fees, which also appears as a line item in the balance sheet. Accrued as the name suggest means an income or expense has earned /recognized even though the related receivable / payable has a future date.

Under the matching principle, you would recognize the $50 cost of the products as an expense in the current quarter because that is when the sale occurred. This matches the expense of the products to the same period as the revenue the products generated. The timing of when you paid for the products does not affect when you record the expense.

An accrued liability occurs when you gain a debt, or incur an expense that you have not paid. Though you don’t exchange cash, you’re obligated to pay the accrued liability in the future. Assume your small business paid $50 last quarter to buy products that you sold in the current quarter.

- In the case that it’s accrued interest that is payable, it’s an accrued expense.

- The cash method is mostly used by small businesses and for personal finances.

- Accruals are things—usually expenses—that have been incurred but not yet paid for.

The practice of appending notes to the financial statements has developed as a result of the principle of full disclosure. The financial statements must disclose all the relevant and reliable information which they purport to represent so that the information may be useful for the users. According to this principle, the financial statements should act as a means of conveying and not concealing. These principles are used in every step of the accounting process for the proper representation of the financial position of the business. Accounting principles are essential rules and concepts that govern the field of accounting, and guides the accounting process should record, analyze, verify and report the financial position of the business.

C corporations (other than farms) must use the accrual method if they have average annual gross receipts for the previous three tax years of more than $5 million [IRC section 448(b)]. The accrual method is also required for tax shelters [IRC section 448(a)], and for general partnerships failing the $5 million test that have a C corporation as a partner (section 448(a)).

Is Accounts Payable an accrual?

Accrual and account payable refer to accounting entries in the books of a company or business. Accruals refer to earned revenues and incurred expenses that have not actually been realized. Accounts payable are short-term debts, representing goods or services a company has received but not yet paid for.

Accrual vs. Account Payable: What’s the Difference?

Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized. Non-GAAP earnings are pro forma earnings figures, adjusted to eliminate one-time transactions to provide a “truer” picture of a company’s performance.

The accountant strives to provide an accurate and impartial depiction of a company’s financial situation. The accrual method is required if the entity fails both the $1 million and the material income-producing factor tests. The cash method is always allowed if the corporation meets the $1 million average revenue test. The cash method is allowed if the company is a qualified personal service corporation. The cash method is always allowed if the entity meets the $1 million average revenue test.

As corporations increasingly need to navigate global markets and conduct operations worldwide, international standards are becoming increasingly popular at the expense of GAAP, even in the U.S. Almost all what are retained earnings S&P 500 companies report at least one non-GAAP measure of earnings as of 2018. The procedures used in financial reporting should be consistent, allowing comparison of the company’s financial information.

How Do Accounts Payable Show on the Balance Sheet?

Accrued expenses generally are taxes, utilities, wages, salaries, rent, commissions, and interest expenses that are owed. Accrued interest is an accrued expense (which is a type of accrued liability) and an asset if the company is a holder of debt—such as a bondholder.

Accrued expenses are expenses, such as taxes, wages, and utilities, that have accrued but not yet retained earnings been paid for. Accruals are things—usually expenses—that have been incurred but not yet paid for.

Why do we use accrual basis for GAAP?

An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed, respectively, and for which the related cash amounts have not yet been received or paid out.

In this case, you credit the cash account because you paid the expense with cash. Usually, an accrued expense journal entry is a debit to an expense account.