To know the way profitable your company is, you have to look at internet revenue margin. Most of the time, web revenue margin is what folks talk about to determine profitability.

A fifty six p.c revenue margin signifies the corporate earns 56 cents in profit for every greenback it collects. A internet revenue margin of 23% means that for every greenback generated by Apple in gross sales, the company kept $0.23 as revenue forex broker. Apple’s net sales or income was $61B, and their price of sales or cost of goods offered was $37.7B for the period. Profit marginis a share measurement of revenue that expresses the quantity a company earns per dollar of sales.

How does gross margin and net margin differ?

Use this small business metric to measure your organization’s progress and health. Use gross margins to look at the profitability of a single product or service. That method, you understand which objects are essentially the most and least worthwhile. You can use profit https://en.wikipedia.org/wiki/Foreign_exchange_market margin to track your corporation’s health and make better business choices. Profit margin can also provide info for investors comparing firms with similar revenue.

How Can You Improve Your Profit Margin?

What is profit margin formula?

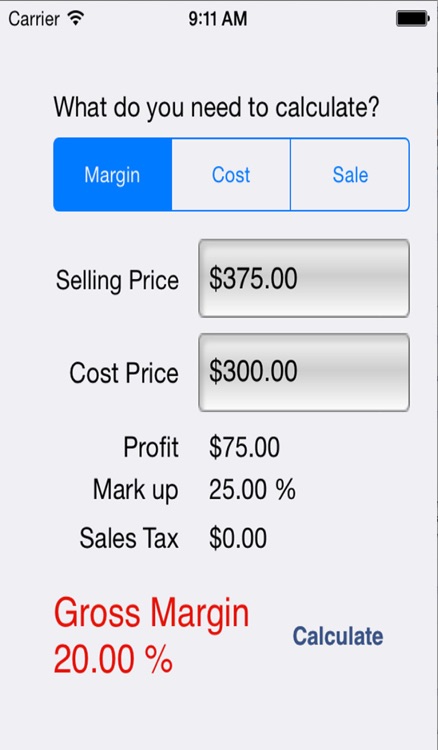

((Price – Cost) / Cost) * 100 = % Markup If the cost of an offer is $1 and you sell it for $2, your markup is 100%, but your Profit Margin is only 50%. Margins can never be more than 100 percent, but markups can be 200 percent, 500 percent, or 10,000 percent, depending on the price and the total cost of the offer.

By monitoring will increase and reduces in its web profit margin, an organization can assess whether present practices are working and forecast earnings primarily based on revenues. Because firms categorical net profit margin as a percentage rather than a dollar amount, it is attainable to check margin calculator the profitability of two or more businesses no matter size. The net profit margin is the same as how a lot internet earnings or revenue is generated as a share of revenue. Net profit margin is the ratio of net profits torevenuesfor a company or enterprise phase.

Profit proportion

It’s greatest to make the most of several ratios and monetary metrics when analyzing a company. Net revenue margin is often utilized in financial analysis, along with gross revenue margin and working profit margin. Net revenue margin is the percentage of revenue generated from income after accounting for all expenses, costs, and cash move items. Net profit margin is likely one of the most important indicators of an organization’s monetary well being.

Gross profit, the primary stage of profitability, tells analysts how good a company is at making a product or offering a service in comparison with its rivals. Gross revenue margin, calculated as gross profit divided by revenues, allows analysts to check business models with a quantifiable metric.

Markup Vs. Margin Explained For Beginners – Difference Between Margin and Markup

The cards also needs to define the difference between the margin and markup terms, and present examples of how margin and markup calculations are derived. Markup is the amount by which the cost forex calculator of a product is elevated in order to derive the promoting value. To use the preceding instance, a markup of $30 from the $70 value yields the $a hundred worth.

Larger sales figures are nice, however be sure to’re incomes most money on these sales. A good profit margin very much depends on your industry and growth objectives and a host of other factors, just like the financial system.

Why is profit margin important?

In the apparel segment of retail, brands typically aim for a 30-50% wholesale profit margin, while direct-to-consumer retailers aim for a profit margin of 55-65%. (A margin is sometimes also referred to as “markup percentage.”)

If occasions are powerful and revenue margins are shrinking, your precedence may be to turn them around. Suppose your profit margin is 10%, which is common in your industry. Whether that is a good profit margin relies upon each in your scenario and your objectives. If you use the online profit method to calculate your ratio for the past two or three years, you can see whether or not the ratio is steady, improving or shrinking. If you are a small, scrappy startup, lots of expenses, such as stock and payroll, may be small.

Net revenue margin is your metric of selection for the profitability of the firm, as a result of it seems at whole gross sales, subtractsbusiness bills, and divides that determine by total income. If your new enterprise brought in $300,000 final year and had bills of $250,000, your web profit margin is sixteen%. One of the most typical methods of pricing products is to adjust the cost of goods bought by the goal revenue margin.

What is profit margin percentage?

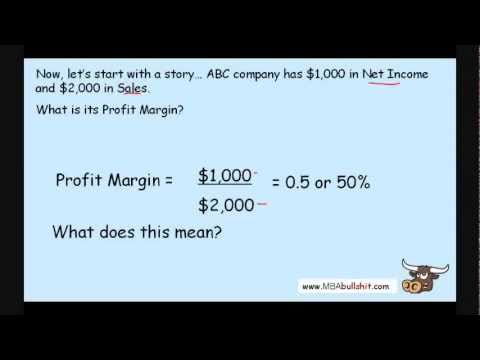

It is computed by dividing net profit by total sales for a given accounting period and multiplying the resulting figure by 100. As an example, a company with a net profit of $1,000 and a total sales of $10,000 will yield a net profit margin of 10 percent (1,000 divided by 10,000 multiplied by 100).

What is revenue margin?

- Net profit margin is the ratio of internet income torevenuesfor an organization or business segment.

- Gross profit margin is the gross profit divided by whole revenue and is the proportion of income retained as profit after accounting for the price of items.

- Both ratios are expressed in percentage terms but have distinct variations between them.

- It’s fascinating how some people prefer to calculate the markup, whereas others suppose when it comes to gross margin.

- Operating Income Before Depreciation and Amortization is a measure of performance to point out profitability in business activities.

- Knowing how this tool may be applied to your business can imply the distinction between a profit and a loss on the end of an accounting interval.

Does margin mean profit?

A good EBITDA margin is a higher number in comparison with its peers. A good EBIT or EBITA margin also is the relatively high number. For example, a small company might earn $125,000 in annual revenue and have an EBITDA margin of 12%. A larger company earned $1,250,000 in annual revenue but had an EBITDA margin of 5%.

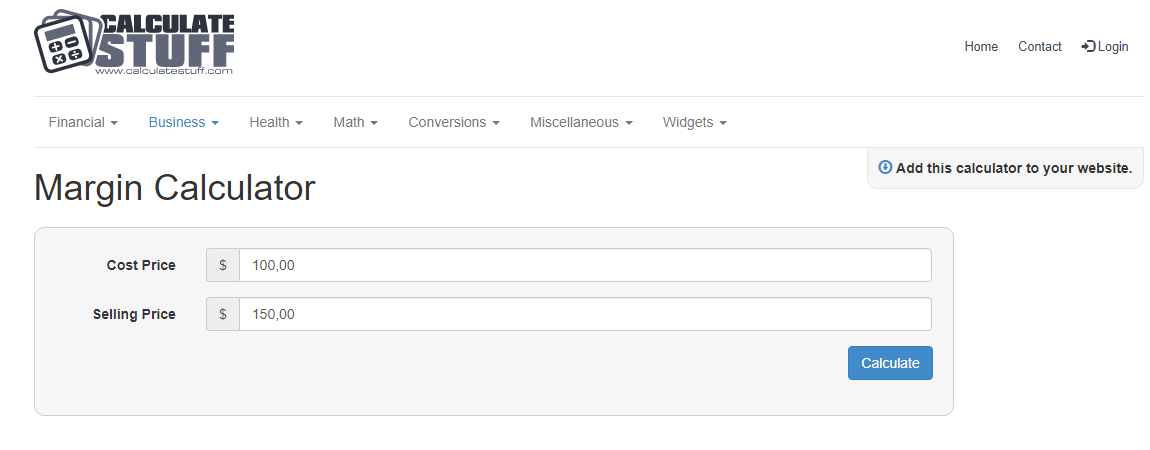

There are a number of layers of profitability that analysts monitor to evaluate the performance of a company, including gross revenue, operating profit, and net income. Operating profit, also called internet revenue or web profit margin, exhibits the quantity of income left after deducting promoting, general, and administrative (SG&A) prices. This margin calculator might be your greatest friend if you want to discover out an item’s income, assuming you realize its price and your desired profit margin proportion. In general, your profit margin determines how healthy your organization is – with low margins you’re dancing on skinny ice and any change for the more severe could lead to massive trouble.

Net Profit Margin

The web profit margin shows whether or not will increase in revenue translate into elevated profitability. Net profit contains gross revenue (income minus cost of products) whereas also subtracting working expensesand all other bills, such as curiosity paid on debt and taxes.

How do you calculate margin markup?

The net profit margin is equal to how much net income or profit is generated as a percentage of revenue. Net profit margin is the ratio of net profits to revenues for a company or business segment. The net profit margin illustrates how much of each dollar in revenue collected by a company translates into profit.

Consider the type of business you run, the variety of workers you could have, and enterprise location. Operating methods, use of business belongings, and stock management also influence profit margin. If you’re capable of create a Product for $a hundred and promote it for $150, that’s a Profit of $50 and a Profit Margin of 33 p.c. If you’re in a position to sell the same product for $300, that’s a margin of sixty six percent.

It permits you to learn how you fare as a enterprise supervisor compared to your rivals. Knowing how this tool can be applied to your corporation can imply the difference between a revenue and a loss on the end of an accounting interval. Suppose ABC company earns $20 million in income from producing widgets and incurs $10 million in COGS-related expenses. One can calculate the gross margin because the gross revenue of $10 million divided by $20 million, which is zero.50 or 50%.

Gross profit margin is your revenue divided by revenue (the raw sum of money made). Net revenue margin is revenue minus the price of all different bills (hire, wages, taxes and so on) divided by revenue. While gross profit margin is a useful measure, traders are more doubtless to take a look at your internet revenue margin, because it shows whether or not operating costs are being covered.

How do you get a 100 profit margin?

Your profit margin shows how much money your business is making, the general health of your business and problems within your business. “Profit margin is important because, simply put, it shows how much of every revenue dollar is flowing to the bottom line,” said Ken Wentworth of Wentworth Financial Partners.

Margins can never be more than one hundred pc, but markups could be 200 %, 500 %, or 10,000 percent, relying on the worth and the total cost of the supply. The higher your value and the decrease your price, the higher your markup. Cost of products offered (COGS) is outlined position size calculator because the direct prices attributable to the manufacturing of the products offered in a company. Gross revenue is the revenue a company makes after deducting the costs of creating and promoting its products, or the costs of providing its services.

Knowing your markup, markup percentage and profit margin numbers are one of the simplest ways to make sure your corporation is profitable. This will assist you to make higher, extra knowledgeable enterprise decisions. Larger revenue margins (over 50%) means you are making more money on each service or product sold. Charging a 50% markup in your products or services is a safe wager, because it ensures that you are incomes enough to cowl the prices of manufacturing plus are incomes a profit on high of that.

The revenue margin is a ratio of a company’s revenue (gross sales minus all expenses) divided by its income. The profit margin ratio compares revenue to sales and tells you how well the corporate is handling its funds total. If the whole bills are $seventy five,000 (value of goods sold and operating costs) and the revenue is $one hundred,000, the net earnings is $25,000. Sometimes, profit margin is confused with internet revenue, however there is a difference between revenue and profit margin. Profit exhibits the greenback quantity your corporation retains after prices, not the share.

However, company X locations a 50% markup on the product, while firm Y places a 30% markup on the product. The revenue will remain proportional even when your cost of products offered increases or decreases. Once you determine the portion the price of items offered represents, divide the cost of items offered by this determine to provide you with the selling price.

To us, what’s extra necessary is what these phrases mean to most individuals, and for this easy calculation the differences do not actually matter. Luckily, it’s likely that you already know what you want and tips on how to deal with this data. This tool will work as gross margin calculator or a profit margin calculator. As you possibly can see, margin is a straightforward percentage calculation, but, as opposed to markup, it is based on revenue, not on Cost of Goods Sold (COGS).

A margin that stays the same means there isn’t a improvement or decline in performance degree. Sales may rise and expenses could go down, but no enchancment or decline in efficiency has been achieved if the identical margin is generated from one interval to the next. It is feasible that even with extra sources when it comes to labor, money and time, your capacity to generate profit this period is still at the same level as final interval’s. by Raul Avenir An improve in sales does not at all times translate to a rise in revenue margin. Operating Income Before Depreciation and Amortization is a measure of performance to show profitability in business activities.

The higher the worth and the decrease the fee, the higher the Profit Margin. Again, these guidelines vary widely by industry and firm measurement, and can be impacted by quite a lot of different factors.

So the difference is totally irrelevant for the aim of our calculations – it doesn’t matter in this case if costs embrace marketing or transport. Most of the time folks come here from Google after having searched for different key phrases. All the terms (margin, revenue margin, gross margin, gross profit margin) are a bit blurry and everybody https://www.umarkets.com/ makes use of them in slightly totally different contexts. For example, costs may or might not embrace expenses apart from COGS – often, they do not. In this calculator, we are using these phrases interchangeably and forgive us if they are not in line with some definitions.