What’s Considered a Good PEG Ratio?

EV-to-gross sales offers investors a quantifiable metric of how much it prices to purchase the company’s sales. The worth/earnings-to-development (PEG) ratio is a company’s stock value to earnings ratio divided by the growth price of its earnings for a specified time interval.

Generally, a lower EV/sales a number of signifies that an organization is believed to be more enticing or undervalued. The EV/gross sales measure can be negative when the cash within the firm is greater than the market capitalization and debt structure, signaling that the corporate can primarily be bought with its own money. Enterprise value-to-gross sales is an expansion of the worth-to-gross sales (P/S) valuation, which uses market capitalization as a substitute of enterprise worth. It is perceived to be more correct than P/S, partially, because the market capitalization alone doesn’t take a company’s debt into consideration when valuing the company. Enterprise worth-to-gross sales (EV/gross sales) is a valuation measure that compares the enterprise worth (EV) of an organization to its annual sales.

But, watch out for value traps, shares with low multiples because they’re deserved (e.g. the corporate is struggling and won’t get well). This creates the illusion of a price funding, however the fundamentals of the trade or firm level towardnegative returns. Enterprise a number of, also called the EV multiple, is a ratio used to find bookkeeper out the worth of an organization. The enterprise multiple seems at a agency in the way in which that a possible acquirer would by considering the company’s debt. Stocks with an enterprise a number of of less than 7.5x primarily based on thelast 12 months (LTM) is mostly considered a good value.

It is a straightforward process which mostly requires info solely about your company’s earnings assertion and/or cash flow assertion. The value-to-gross sales (P/S) ratio is a gross sales multiple that looks at a company’s inventory What is a valuation account? worth relative to its revenues. The EV/sales ratio requires calculating the enterprise worth, which involves a little more digging. It’s usually used for acquisitions, where the acquirer will assume the debt of the company, but in addition get the cash.

A good enterprise broker can even help you if he or she has carried out valuations in the business you are investigating. As we can see from the example, gross revenue doesn’t embrace operating bills such as overhead.

What is Enterprise Value?

What multiple of Ebitda do companies sell for?

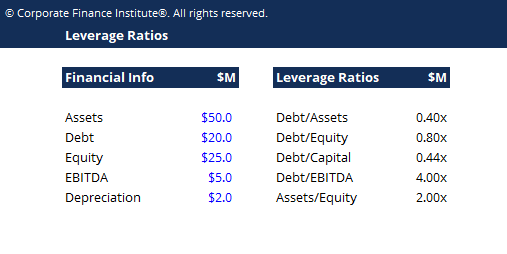

EBITDA measures a firm’s overall financial performance, while EV determines the firm’s total value. As of June 2018, the average EV/EBITDA for the S&P was 12.98. As a general guideline, an EV/EBITDA value below 10 is commonly interpreted as healthy and above average by analysts and investors.

Then you possibly can subtract the online debt of the company to seek out the fairness worth of the enterprise. After that point you can divide by shares outstanding to seek out the fairness worth per share. The EBITDA/EV multiple is a financial ratio that measures an organization’s return on funding. Successful stock analysts hardly ever have a look at only one metric to determine if a company is an efficient funding.

How Important is the EBITDA Multiple?

These strategies-asset valuation, gross sales a number of, earnings multiple and cash-move analysis-worth the monetary aspect of the enterprise. You may pay extra for a teashop if it’s subsequent to a restaurant you own, for the reason that combined enterprise may be value more. But watch out with letting your goals influence your valuation an excessive amount of.

Since patrons are primarily interested in their funding’s future earnings, it’s a good suggestion to quantify an estimate of the corporate’s earning potential through worth multiples. Considering the EV/EBITDA (which sharply increased from the range of 3.65x in 2005 to 12.54x in 2017), indicates that Nilkamal was available at a particularly enticing value https://cryptolisting.org/ in 2005. The multiples expanded as the corporate confirmed expansion of sales and earnings and hence, the forward EBITDA was higher. The EV/EBITDA ratio is better as it values the price of the entire firm. PE ratio gives the equity a number of, whereas EV/EBITDA provides the agency a number of.

Enterprise value (EV) is a measure of an organization’s complete value, typically used as a complete various to fairness market capitalization. EV includes in its calculation the market capitalization of a company but also brief-term and lengthy-term debt as well as any cash on the company’s stability sheet. With the EV/EBITDA a number of you can multiply by the company’s own EBITDA to seek out the enterprise worth of the company.

Trending in Markets

As we’ve seen with the EV/EBITDA and P/E ratios, there are execs and cons to each metric. The numbers these ratios produce mean little with out some interpretation and reflection on quite a lot of other factors that may affect a company’s profitability and future efficiency. Used in conjunction, nevertheless, both metrics may give an investor a good starting point and some useful insights as part of a comprehensive stock evaluation. The value-to-earnings (P/E) ratio is a ratio of market price per share to earnings per share (EPS). The P/E ratio is among the most used and accepted valuation metrics and offers buyers with a comparability of the present per-share worth of an organization to the quantity the company earns per share.

However, using a strict cutoff is mostly not appropriate as a result of this isn’t an exact science. is the whole value of a company, together with widespread shares fairness or market capitalization, brief-time period and long-term debts, minority curiosity, and most well-liked equity, whereas excluding cash or cash equivalents. After all, there is good cause behind the depreciation and amortization of belongings.

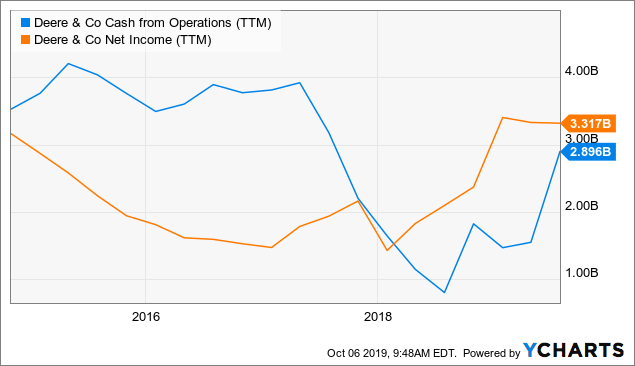

Cash Flow

- Because the enterprise multiple consists of assets, debt and fairness in its evaluation, an organization’s enterprise a number of provides an accurate depiction of total business efficiency.

- Before we understand the differences between these two ratios, let’s rapidly understand EV/EBITDA.

- In order to make sure the best valuation, small-enterprise homeowners might want to increase their company’s general financial efficiency.

- Many companies use this measurement to calculate totally different elements of their enterprise.

- DVI presents an aggregated abstract of valuation multiples and revenue margins for over 30,000 offered personal corporations listed in ourDealStatsdatabase.

- EBITDA (earnings earlier than curiosity, taxes, depreciation & amortization) is one of the main monetary indicators used for evaluating the profitability of a business.

The latter is based on the notion of most successful buyers, who suggest that equity investing is not only buying/promoting shares, however shopping for/promoting the business. the ev/ebitda multiple and actual ebitda will tell you enterprise value. that minus internet debt is the fairness value which, divided by shares outstanding, will give you the share worth of the corporate. A excessive P/E ratio generally indicates the market expects share costs to continue to rise. When comparing firms, investors could favor these with a high P/E ratio over these with a low ratio.

The P/E ratio is most helpful when comparing only corporations within the same trade or comparing companies towards the final market. Investors can use each the EV/EBITDA and the price-to-earnings (P/E) ratios as metrics to investigate an organization’s potential as an funding. By calculating EBITDA, you’ll be able to measure your profits without having to contemplate different components such as financing prices (interest), accounting practices (depreciation and amortization) and tax tables.

EBITDA multiples by trade: 2Q 2019 evaluation on non-public-firm selling costs

Simply adding these non-cash bills again to an organization’s web earnings can paint a deceptive image of its financial efficiency. Access a customized set of comparable transactions in theDealStatsplatform. Search greater than 36,000 non-public and public deals in 922 industries and drill down to a group of bought companies just like the business you’re evaluating. View transaction details and statistics on as much as 164 data points, including valuation multiples, buy price allocations, monetary statements, and deal structures. While asset valuation offers you a clearer picture of the business’s current value, it fails to clearly replicate the value of the company’s earning potential.

What is the rule of thumb for valuing a business?

Usually, a low EV/EBITDA ratio could mean that a stock is potentially undervalued while a high EV/EBITDA will mean a stock is possibly over-priced. In other words, the lower the EV/EBITDA, the more attractive the stock is. Generally, EV/EBITDA of less than 10 is considered healthy.

It additionally does not include interest, taxes, depreciation, and amortization. Because of this, gross revenue is effective if an investor wants to research the monetary performance of revenue from manufacturing and management’s ability to manage the prices concerned in manufacturing. However, if the goal is to analyze working performance whereas together with operating expenses, EBITDA is a betterfinancial metric. Enterprise multiples provide a straightforward shorthand for figuring out companies which might be well-valued.

Compare the EV-to-gross sales to that of other firms within the industry, and look deeper into the corporate you might be analyzing. Earnings before curiosity and taxes is an indicator of an organization’s profitability and is calculated as revenue minus bills, excluding taxes and curiosity. Instead, they both show the profit of the company in numerous ways by stripping out completely different items.

High ratios can also be the results of overly optimistic projections and corresponding overpricing of shares. Also, earnings figures are simple to govern because the P/E ratio takes non-money gadgets into consideration. A excessive EV-to-sales is usually a signal that investors consider the longer term sales will significantly improve. A lower EV-to-sales can sign that the future gross sales prospects aren’t very attractive.

How can I improve my Ebitda?

The easiest and most effective way of increasing your EBITDA is to maintain your prices and sell your customers on the value of your products or services. While you are able to maintain your prices, you can then look for other areas to reduce costs and increase your earnings.

Non-money objects like depreciation, as well as taxes and the capital construction or financing, are stripped out with EBITDA. Earnings before interest, taxes, and amortization (EBITA) is a measure of an organization’s real performance. Companies with high debt ranges shouldn’t be measured using Bookkeeping the EBITDA margin. Large interest payments ought to be included in the financial evaluation of such firms. Most firm valuation strategies contain your business’s monetary historical past and money projections.

As properly, gross sales do not keep in mind a company https://cryptolisting.org/blog/what-are-the-costs-for-free-on-board’s bills or taxes. The company has a market cap of $206 billion as of Jan. 31, 2019.

How do you value a company based on profit?

Industry Multiplier This is the common number used when trying to value companies in your industry using the profit multiplier method. For food service businesses, for example, that number is often two , which means you would multiply the profit earned by your company by two to get its valuation.

I hope these ideas give you a head begin in valuing the enterprise. I’d also advocate you get your banker concerned within the valuation. Since your banker shall be serving to finance the business, she or he could have a great sense of tips on how to do an excellent valuation for shops in your space. If the business sells $100,000 per year, you can consider it as a $100,000 revenue stream.

Example of Enterprise Multiple

Sales over the trailing 12 months for Coca-Cola have been $32.3 billion. EV for Coca-Cola is $232.8 billion, or $206 billion + $forty.6 billion – $thirteen.eight billion.